Chinese New Year impacts sales as usual but some brands felt the heat more than others while others flourished.

China’s New Energy Vehicle (NEV) sales figures are in for February and, as expected, it’s a mixed bag of results, some brands flying high while others took their foot off the gas. Let’s dive right in.

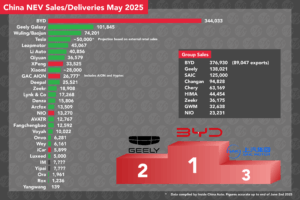

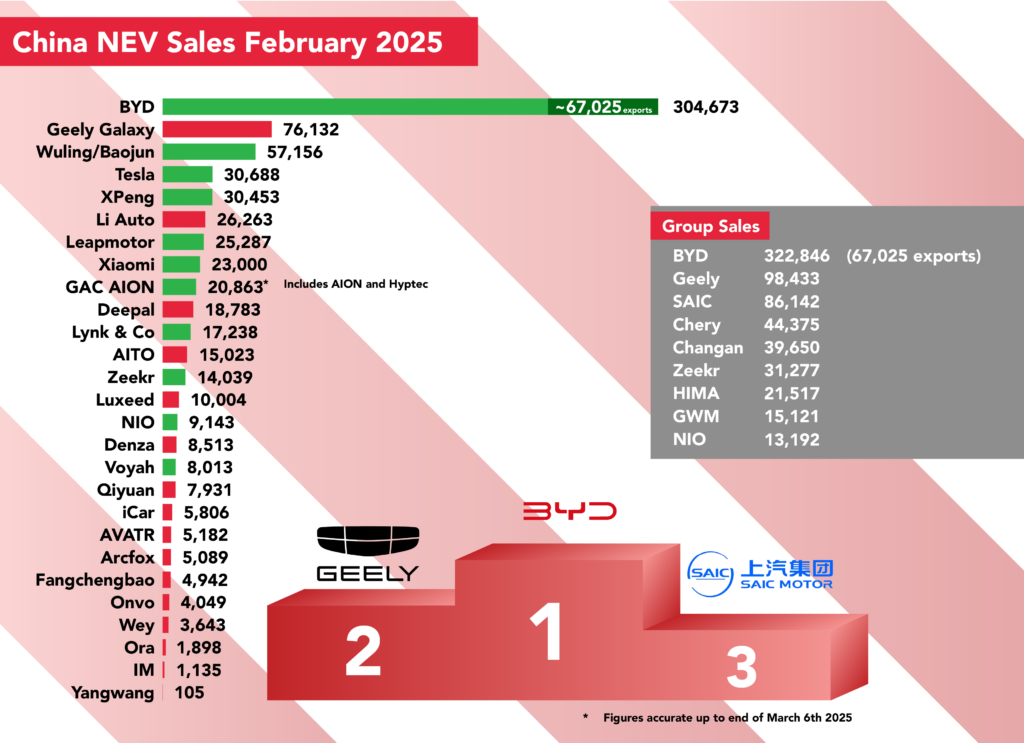

BYD once again led the way in Chinese new energy vehicle (NEV) sales posting a mild improvement on January but still falling way short of their end-of-year heroics.

Lower than usual numbers are expected in the first two months of the year due to the Spring Festival interruption, but no such issues affect exports which reached a new peak of 67,025 units, more than double the figure of November, suggesting international performance is starting to pick up.

For the combined months of January and February, BYD saw a sales hike of 90 percent, confirming that their relentless pace continues unabated as they rapidly climb the global automaker sale charts.

Fortunes at BYD Group’s other brands weren’t quite as impressive, Denza down 27 percent to 8,513 units from the month prior, Fangchengbao down 21 percent to 4,942 units , and Yangwang down to 63 percent to just 105 units.

Taking second spot in both the brand and group tables once again was Geely whose pursuit of BYD remains some way off at this stage, albeit the gap does seem to be narrowing.

Their 98,433 group NEV sales, Geely Group including the standard Geely Star range and the Geely Galaxy range, fell just short of the 100,000 mark at 98,433 units, 194 percent up on the same month last year, demonstrating impressive growth.

Geely Galaxy models made up 76,132 of that number, 288 percent up on February last year thanks to a bunch of new models joining the range last year, underlining their rapid ascent past local rivals such as Chery, Changan, and SAIC.

The Wuling-Baojun arm of the SAIC conglomerate, otherwise known as SGMW, continues to occupy a podium place, combined sales of 57,156 up three percent on January. 42,451 units of this were from Wuling, whose larger five-door Hongguang Mini just recently went on sale but won’t really be reflected in this figure.

SAIC sales rebounded in February, up 41 percent on last year to 86,412 units, though troubles loom large at their flagship IM brand whose falling recent sales almost flatlined completely in February, down 59 percent to just 1,135 units.

International sales for the brand cannot come soon enough, with Thai sales of the MG-badged IM L6 set to begin this month and further markets set to open up throughout 2025.

Entering the ‘everybody else’ category, Tesla just about took fourth spot according to reports, though a poor performance here is likely a result of customers waiting on new Model Y deliveries which have just begun in March.

Reports of 30,688 sales from some media put them marginally ahead of the revitalised XPeng who pipped January’s sales with another 30,000-plus month, 30,453 units enough for them to beat out Li Auto for a second consecutive month and an improvement of 570 percent on last year’s result.

Li Auto followed, February’s sales of 26,263 units way down on their December peak, but still way up on their 2024 performance and, critically, far ahead of sales from rival brand AITO. Their i8 fully-electric SUV was revealed during the month but won’t go on sale until later this year.

Leapmotor maintained their pace from January, 25,287 sales a 285 percent increase from February last year, with more likely to come when their B10 compact SUV goes on sale in a couple of months.

Xiaomi’s meteoric rise continues, around 23,000 sales taking them into 8th spot even before sales of the YU7 SUV begin in the summer. The launch of their record-breaking SU7 Ultra also attracted more than 15,000 pre-orders in just a few hours after the launch.

GAC AION had a strong month, 20,863 units a 45 percent improvement on January’s low point, and that despite the UT compact hatchback only going on sale at the very end of the month, suggesting March could see a return to better numbers.

Changan’s Deepal brand, now launched in Australia, dropped 24 percent in February to 18,783 in a stalling of their recent good form, while sister brand Qiyuan also fell 27 percent to just 7,931 units. Changan Group sales fell by a similar amount to 39,650, with the part-owned AVATR brand also down 41 percent to 5,182 units.

It was a better month for the Zeekr Group, however, Lynk & Co posting an improvement to 17,238 units, 11 percent up on January, and Zeekr itself selling 14,039 units, up nearly 18 percent on January and almost 87 percent ahead of last year’s February result.

Zeekr was sandwiched between Huawei’s AITO and Luxeed brands, posting 15,023 and 10,004 sales respectively, although confusion reigns with these figures given those two numbers alone outstrip the 21,517 units posted for the Harmony Intelligent Mobility Alliance.

The same issue occurred last month so we’ll try to get to the bottom of it. Both figures were down on January’s results.

Next up NIO, whose sales continue to perplex. 9,143 units for the NIO brand was a decent result, up 15 percent on January and up 12 percent on the same month last year, but sub-brand Onvo appears to be going in the other direction, down 32 percent to 4,049 units despite an impressive product at a very tempting price point.

Voyah sales remained stable at 8,013 units, four units up on January, and 152 percent up on the same month last year. Their sales remain almost 90 percent supported by the Dreamer MPV, though international markets continue to open up.

Chery’s iCar brand posted a 26 percent decrease on January’s figures with 5,806 units, while BAIC’s Arcfox sales dropped 15 percent to 5,089 units, both brands struggling to get out of second gear in recent times.

The table is concluded by Great Wall brands, with SUV brand Wey falling 27 percent from January to 3,643, and Ora down 13 percent on already lacklustre results to 1,898.

Both brands combined make up only 36 percent of Great Wall’s 15,121 units, a staggeringly poor return given both are the focus of GWM’s NEV efforts. Plug-in hybrids from the brand’s Tank and Haval brands seem to be making the real in-roads, suggesting one or both could be for the chopping block if improvements don’t come soon.