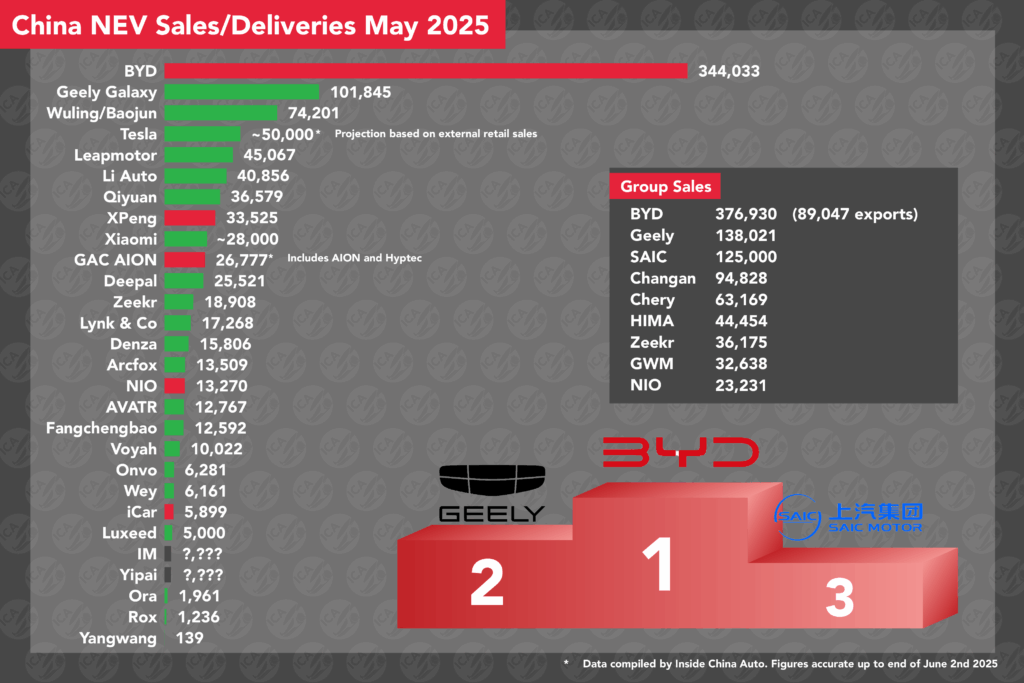

Records set at several of the in-form brands, but tough times for NIO and GAC AION.

The near-complete sales and delivery results for new energy vehicles in China are in, and it’s been a bumper May for almost all brands on the list, with some producing outstanding results and many setting new records.

Let’s dive right into the numbers.

BYD’s ongoing reign at the top of China’s NEV leaderboard shows no signs of being overthrown any time soon, another strong month for them with 344,033 units delivered globally, a fraction short of last month but not by much.

Year-on-year growth is equally in keeping with the overall growth of the market, up 36 percent, but the outlook for the China market only is starting to dim slightly.

Of the group’s total 376,930 units delivered in May, 89,047 were exports, the highest number yet, and given the vast majority of those are BYD-branded models, it suggests a little stagnation at home with this the second consecutive month of declining monthly numbers.

Not exactly the end of the world but something BYD might want to keep one eye on with Geely’s Galaxy range gobbling up chunks of market share.

Speaking of Geely Galaxy, their range continues its stellar run, topping the magical 100,000 units for the first time, 101,845 deliveries in May a new record for the purely NEV brand.

That’s a healthy five percent gain on April’s figures, and an astounding 273 percent gain on the same month last year, showing just how far the range has come in a short period of time.

The Geely Geome Xingyuan has topped China’s NEV tables a few times, ousting the evergreen BYD Seagull, and more models are on the way with the M9 large SUV released just a week ago.

Securing their now customary bronze medal is the Wuling Baojun partnership, showing good improvement in May with 74,201 units being a six percent improvement on last month, and a 52 percent improvement on last year.

52,907 of those were from the Wuling brand itself, meaning 21,294 were from the Baojun range, both brands adding to their numbers from April.

The Wuling Hongguang MINI EV continues to play a huge role in that, combined sales of the three- and four-door versions making up 29,017 units.

Bit of a placeholder here as we’re waiting on more concrete numbers from Tesla but sales reports from May suggest we’re looking at a number around 50,000 units, this time being sales, not deliveries.

That would be quite a hefty jump on last month, April being more of an export month for vehicles from GigaShanghai, but if the number is correct, we’re looking at a roughly nine percent drop on last year, suggesting overall numbers aren’t moving in the right direction at Tesla.

We’ll update this number as and when we get more accurate figures.

Leapmotor’s rise continues unabated, their 45,067 units a new record for the brand as they edge closer to 50,000 units, which may become a possibility when the B01 saloon revealed at the Shanghai Auto Show starts deliveries.

A sizeable ten percent gain on April’s figures is dwarfed by the 148 percent improvement on last year’s figures as Leapmotor go from strength to strength.

Li Auto’s somewhat steady start to the year came to an end in May, the brand’s best month of the year delivering 40,856 units, a 20 percent gain month-on-month and 17 percent year-on-year.

It’s a welcome return to form for Li who have actually been beating their previous year’s results but have been some way short of their 50,000-plus deliveries from the tail end of last year, and the ramp up seems to be in full swing.

The i8 is next in line for Li, as well as the updated MEGA, so things could improve yet further in the coming months.

Qiyuan had a spectacular return to form in May, recording sales of 36,579 units, up a whopping 224 percent on April’s figures, enough to catapult them up the leaderboard and into seventh place above XPeng.

Sales of the Q07 have clearly had a fantastic start, helping to drive year-on-year growth of 67 percent, and things could get even better with a new A06 saloon is also on the way after it was teased earlier in May.

XPeng extended their run of consecutive months delivering over 30,000 cars, May’s figure of 33,525 units a little down on the month prior but notably 230 percent up on the previous year.

Things look set to get even better for the brand with the G7 set for an imminent launch, the futuristic P7 in line, and a potential new MONA model on the cards as well, which if it can match the success of the 03, could be another massive boost to their sales.

Xiaomi reported numbers in excess of 28,000 units for a second straight month, marginally down on the highs of 29,000 in March, but no concerning slowdowns here.

Year-on-year growth of 224 percent shows how much the brand has ramped up since deliveries of the SU7 began, and now they’re about to embark on doing it all again with the YU7 expected to launch in July.

GAC AION seem to be in something of a downward spiral, the brand way down on their performances in a stellar 2024.

Many brands would still give their left and right hands for 26,777 units delivered in a month, but the momentum certainly isn’t with AION, down a reasonable five percent month-on-month, but 33 percent down year-on-year.

Deepal turned around a limp April with a very solid May, 25,521 units making it their best month of the year with 27 percent gains over last month.

The biggest gains were reserved for the year-on-year figures, an improvement of 78 percent demonstrating the strong gains the brand has made with its range in the past 12 months. They’re now nipping at the heels of GAC AION.

Zeekr delivered their best month of the year in May, 18,908 units their first decent month since the latter stages of last year, and it was enough to see them improve a hefty 38 percent on April’s performance.

A tiny two percent improvement on May last year still underscores that the brand isn’t really making the strides expected of it given the expansion to the range since last May, and the 9X won’t move that needle much when it comes, so perhaps incentives are incoming.

Lynk & Co are on the up and up, 17,268 units a record monthly NEV delivery for the brand, a 13 percent gain on last month and a healthy 39 percent up on last year.

The Z20 in particular continues to do good things for the brand, but deliveries of the new 900 might also have helped boost May’s numbers further.

They’ve been passed by sister-brand Zeekr, but it’s all good for the Group.

Denza sales are moving steadily in the right direction, 15,806 units moved in May equating to a three percent increase over April, and a 29 percent increase over May last year.

The N9 isn’t likely to move the needle too far, unless it can achieve Li Auto levels of success, but a smaller N8L version might start to make a difference, though a launch isn’t imminent.

Arcfox, like the Changan brands, suddenly remembered that it sells cars in May, clocking a massive 80 percent improvement in deliveries over April with 13,509 units making their way to customers.

Year-on-year, it’s an even more impressive 218 percent growth for the brand, which hasn’t really introduced any new cars recently but somehow struck gold this month, storming ahead of NIO in the process.

NIO’s numbers look pretty shaky on the face of things, their 13,270 deliveries in May a whopping 31 percent down on April, but with the release of the updated ET5 and ET5T earlier this week, it’s likely that two of the brand’s biggest sellers were temporarily held back awaiting the new release.

Perhaps more concerning is the 57 percent deficit to last year’s result. Onvo has likely taken a chunk of sales, and the ET5/ET5T situation won’t have helped, but they really should be much closer than they are if not better than last year’s results.

Let’s see if the improvements to the brand’s ageing bestsellers have the optimum effect.

AVATR had their best-ever month in May, 12,767 units bringing them within spitting distance of NIO ahead of them.

Gains were a healthy nine percent on last month, and an even better 179 percent over last year, with the new 06 seemingly having a positive impact on results as well as the extended range drivetrains.

Fangchengbao’s growth went much the way of everyone else in May, with 12,592 deliveries an improvement of 25 percent on April.

Sales of the Tai 3 appear to have started well then, and more models are in the pipeline for BYD’s off-road focused brand, with the Bao 5 and Bao 8 models expected to head abroad badged as Denzas later this year.

Voyah, once again, landed almost squarely on the 10,000 units mark for the third consecutive month, with 10,012, 10,019, and then 10,022 in May.

A little suspicious, we’re not going to lie, but nevertheless an impressive 122 percent gain on last year’s result. No sign of any new cars to come, but a Huawei-equipped FREE might improve things a little.

Take this one with a pinch of salt until we get confirmation, but IM claim on Chinese social media that the updated IM L6 sold and delivered 8,500 units in May.

There are no figures about the brand’s other cars, so this is all we’ve got for now until SAIC publish the data on their website, but if so, it would mark a large uptick for a struggling IM who managed just 4,366 units of their total range in April.

Watch this space. We won’t include them on the main graphic until we have the full number.

Onvo had a very good month in May, 6,281 deliveries a massive 43 percent gain on the previous month, and a very respectable achievement for a one-car brand, at least until the L90 comes in.

Let’s see if June’s results back up May and prove they’ve turned a corner.

Wey haven’t been in particularly great form of late but turned up the heat in May, sales of 6,161 units an improvement of 28 percent on last month, and 115 percent over last year.

They’ll need more months like this to keep things running, their boss Wei Jianjun kicking off a war of words earlier this week by suggesting there is another Evergrande but for the EV industry hiding in plain sight.

iCar suffered something of a setback in May, their 5,899 deliveries a 15 percent drop on the previous month, but still up 42 percent on the previous year.

They do seem to be struggling to break out of the mid 4-digits range, albeit with a small but affordable range, and now Chery looks to be borrowing some of their models to be badged as Cherys in a typically confusing Chery way.

The Kunpeng-driven version of the V23 does seem to be on the way though, with mixed reporting on whether it will be a pure ICE or a hybrid or range extender, and that might help the V23’s biggest issue, range.

Luxeed rolled into May on the back of a rapid decline, having started the year with 13,000 deliveries and landing in April with just 4,461.

A suspiciously round 5,000 in May, an entirely possible figure of course, would be a turnaround from that decline with growth of 12 percent over April, but with stagnant year-on-year growth after rolling out the R7 later last year, things aren’t looking fantastic at Luxeed.

While sister-brand AITO knocks it out of the park in the SUV space, something just isn’t rolling right at Chery-made Luxeed and we’re yet to see what it is.

firefly finally landed in customer hands in May and hit the ground with 3,680 units on the board, which is a bit less than Onvo managed in their first month.

We’re not going to make any conclusions just yet, we don’t know how many days of deliveries the firefly has had in May, so we’ll just stay tuned for June’s results to see how things are going then, though much of firefly’s sales are hoped to be in international markets too, so later results in the year will tell the full story.

Ora finally turned their bar green this month with a steady improvement on poor recent sales, their 1,961 deliveries equal to nine percent growth over last month.

The bigger picture remains that year-on-year growth is way down, 57 percent in fact, and thus the word is that the brand is turning towards PHEVs and away from EVs, despite the Ora Funky Cat getting some minor improvements for 2025.

Another month of improvement for ROX, whose 01 we recently reviewed here, with 1,236 units delivered in May being a ten percent increase on their April data.

But while it may be steady improvement, at this point it’s just that, and while we’re no business experts, it seems unlikely you can keep running a car company for too long with these numbers if the margins aren’t on a par with a Ferrari or a Lamborghini.

There are no signs of trouble just yet, the owner of ROX being a pretty wealthy guy, but they could do with another new product soon.

Yangwang will likely forever remain at the bottom of this table by virtue of their price and target audience, but 139 deliveries in May made it their second best month of the year, a modest gain of three percent on last month.

With the U7 saloon set to hit the market shortly, it’ll be interesting to see what impact it has on these numbers.

Editor’s Note

With pretty much all of the numbers in, what’s clear is that May has been a very good month for almost every brand on the list with far more green on our leaderboard than there was in April.

Many brands made really quite sizeable gains in May and several hit new record highs, even topping their end of year numbers from last year that tend to be very good.

Overall, it suggests a pretty positive outlook for NEVs as a whole and we’ll expect good numbers from the total NEV tally this month, likely nudging 50 percent of overall sales.

The only real losers this month were NIO, GAC AION, and iCar, who in their various ways need a bit of a hand right now. NIO’s number has some reasons behind it, GAC AION simply don’t seem to be either attractive enough or visible enough right now, which is worrying, and iCar seem to have gone off the boil. Next month they could be heroes again, but let’s see.