Record deliveries, revenue growth, margins, and losses come on the back of six consecutive months of 30,000+ deliveries.

XPeng has announced record performance figures in their Q1 Financial Report with key metrics across the board displaying significant improvement as sales skyrocket and global expansion gathers momentum.

On the back of XPeng completing six consecutive months where deliveries topped 30,000 units, they announced record Q1 deliveries of 94,008 vehicles, a hefty 330.8 percent year-on-year (YoY) rise and a quarterly high.

As a result, revenue was also boosted to RMB 15.81 billion, up 141.5 percent YoY, beating expectations in what is generally a quieter period for deliveries in their largest market, China.

Those figures have driven improvements in profitability, notably in gross margin, up to 15.6 percent, a record high, and 10.5 percent on vehicles. In turn, losses have narrowed to RMB 660 million, with more than RMB three billion positive cash flow.

Cash reserves have thus been boosted from last quarter, sitting now at RMB 45.28 billion, up RMB 3.3 billion from last quarter.

Looking ahead

With record deliveries maintaining pace into April, XPeng is projecting Q2 deliveries to rise further to between 102,000 and 108,000 units, up around 247 percent on last year’s numbers, with revenue expected to rise around 122.5 percent to around RMB 18.1 billion.

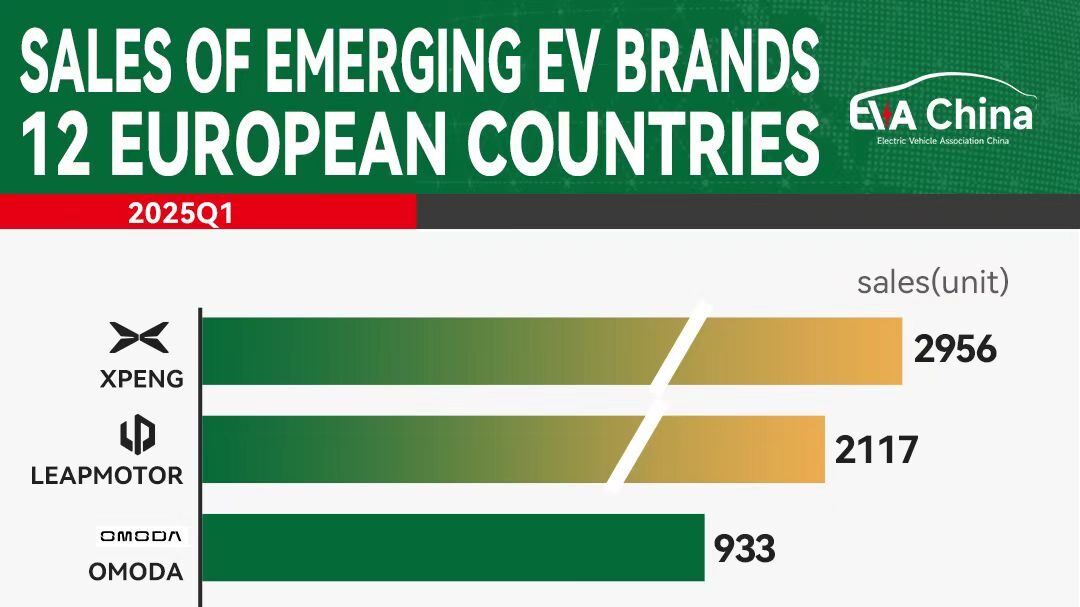

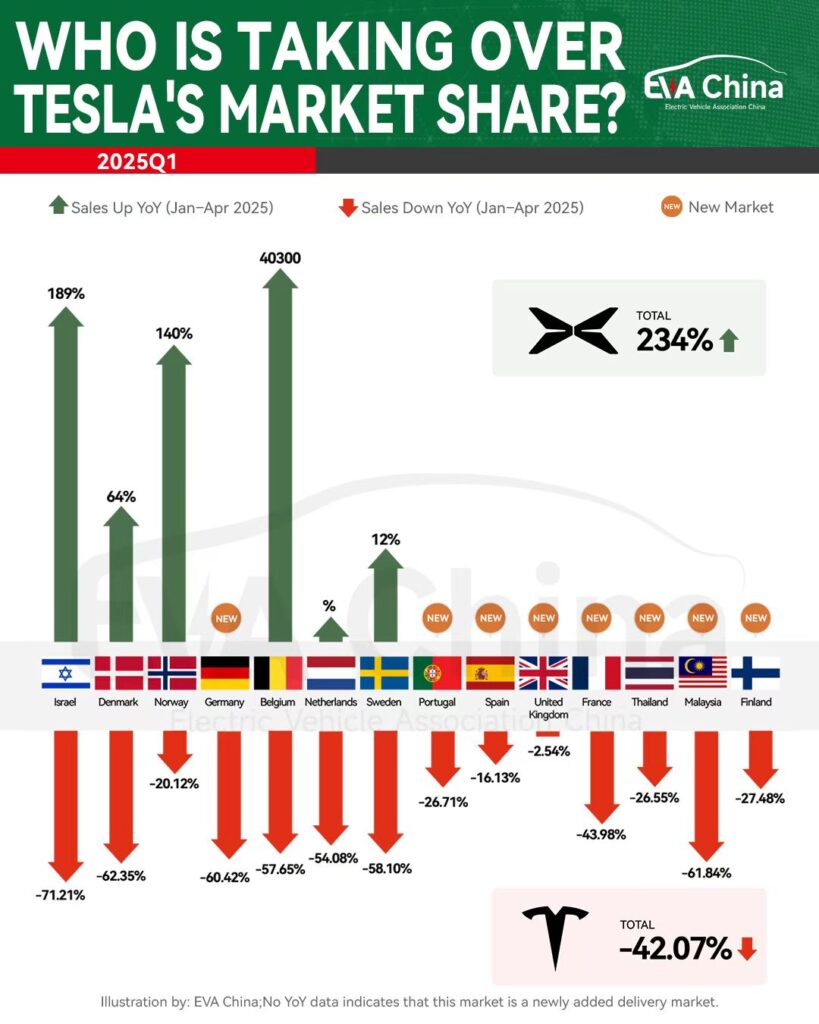

While the majority of XPeng sales remain in China, a large portion of their growth is increasingly coming from export markets, which were responsible for 7,615 of the 94,008 deliveries in Q1, or 8.1 percent, a rise of 370 percent YoY.

As well as expanding into the UK, Indonesia, Italy, and Poland in Q1, XPeng ranked number one amongst Chinese EV start-ups in nine of their export markets, including Singapore and Norway.

This has all led XPeng to predict a more than doubling of sales across 2025 compared to last year, and achieving profitability in Q4 of this year with positive annual free cash flow.

Highlights

Much of the growth in XPeng’s recent sales has come from two models, the MONA M03, which has already surpassed 100,000 deliveries in just eight months on sale, and the more recently released P7+, which has seen almost 50,000 deliveries since November last year.

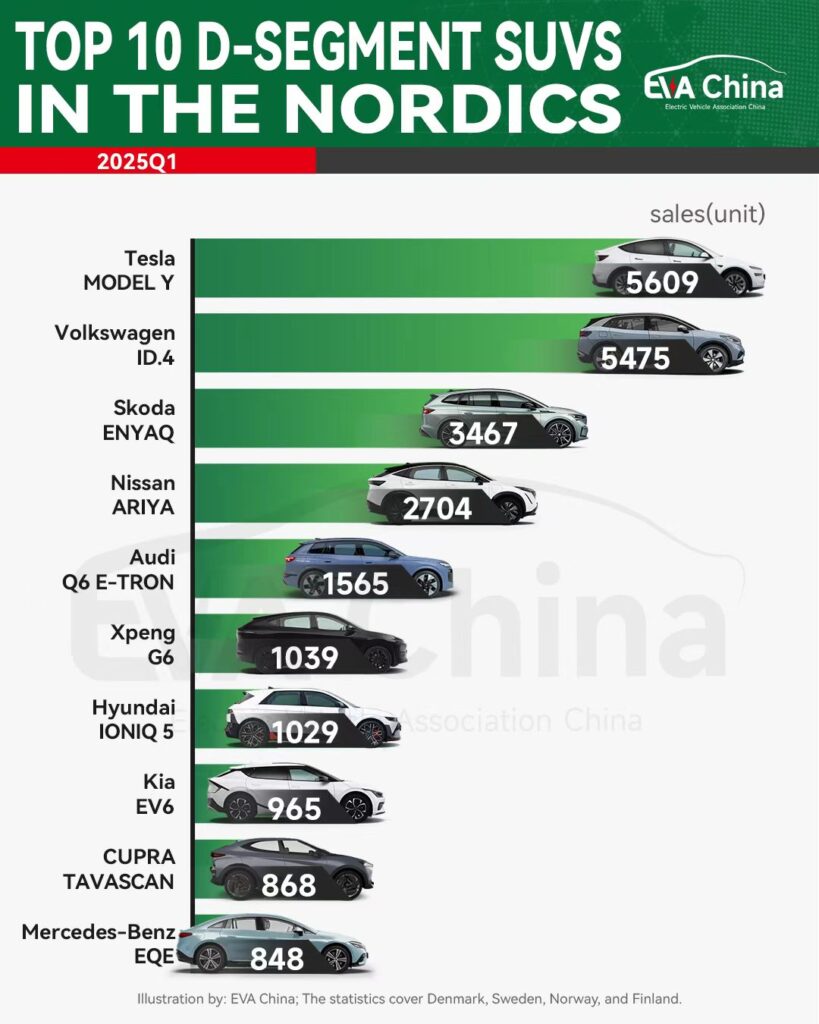

Refreshes to the G6 and G9 line-ups have also reaped rewards, with over 7,500 units delivered between them in April alone, while the G6 took sixth-place in D-segment SUV sales in the Nordic region in Q1.

The X9 MPV was also refreshed and released in April, itself taking 1,603 deliveries in the same month.

A new top edition of the MONA M03, the M03 Max, will launch on May 28th, offering the first high-compute AI assisted driving in the RMB 150,000 segment, while the G7 SUV will launch in June with high hopes it will emulate the success of the P7+ in the RMB 250,000 SUV segment.

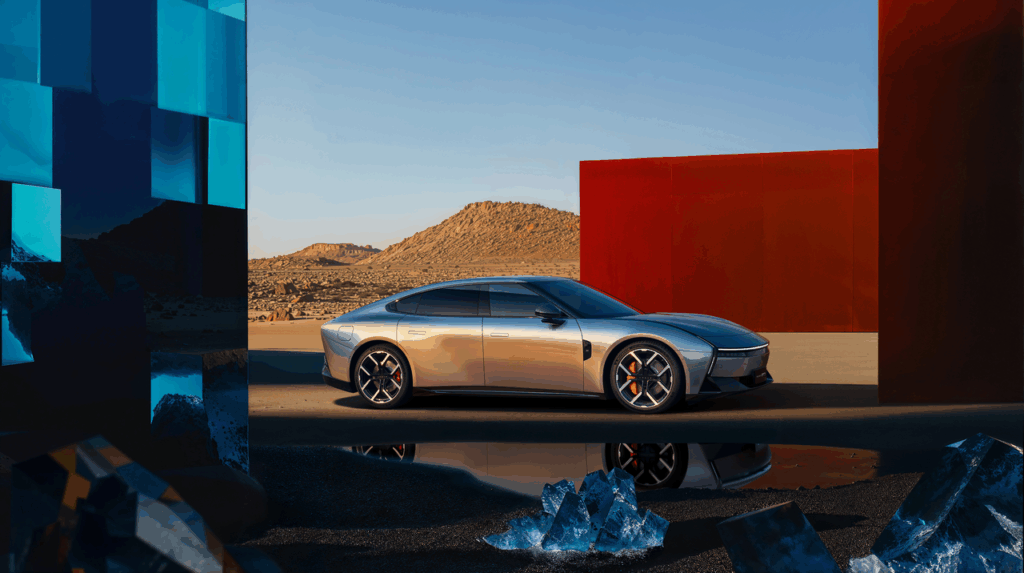

Q3 will see the release of the recently unveiled, futuristic replacement of the popular P7, while Q4 will see the launch of XPeng’s first models equipped with the Kunpeng extended range EV drivetrains.

Tech leader

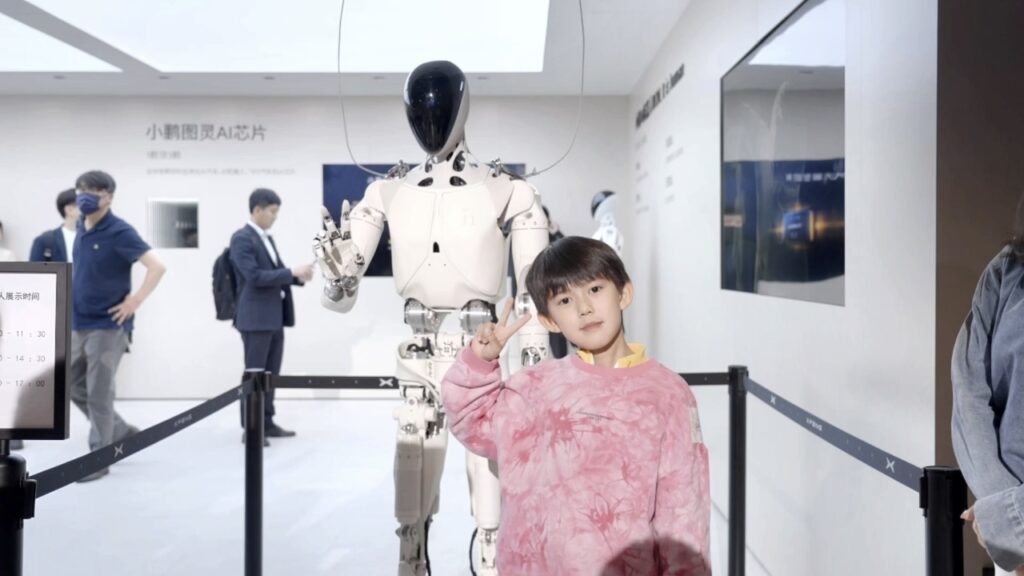

Outside of cars, XPeng continues to bolster its reputation in the fields of computing and humanoid robot technology.

In addition to developing a 72 billion parameter foundation model for vehicles and robots, they will put their in-house developed XPeng Turing AI chip into mass production in Q2 2025.

With processing power triple that of NVIDIA’s Orin-X chip and double that of Tesla’s FSD chip, it will further support the brand’s smart driving credentials which now boasts lidar-free urban smart driving capability.

Meanwhile, their IRON humanoid robot, which is already performing limited tasks in XPeng’s factories, is slated for mass production in 2026 with increased mobility and improved AI interaction. It made its public debut at the Shanghai Auto Show in April.