Full April sales figures are in with a mixed bag of results, some brands hitting new heights, others faltering.

China’s April NEV (new energy vehicle) sales are mostly in now and we’re seeing a real mixed bag of results, with many brands down month-on-month, and some brands even down year-on-year, but mostly up and by some margin.

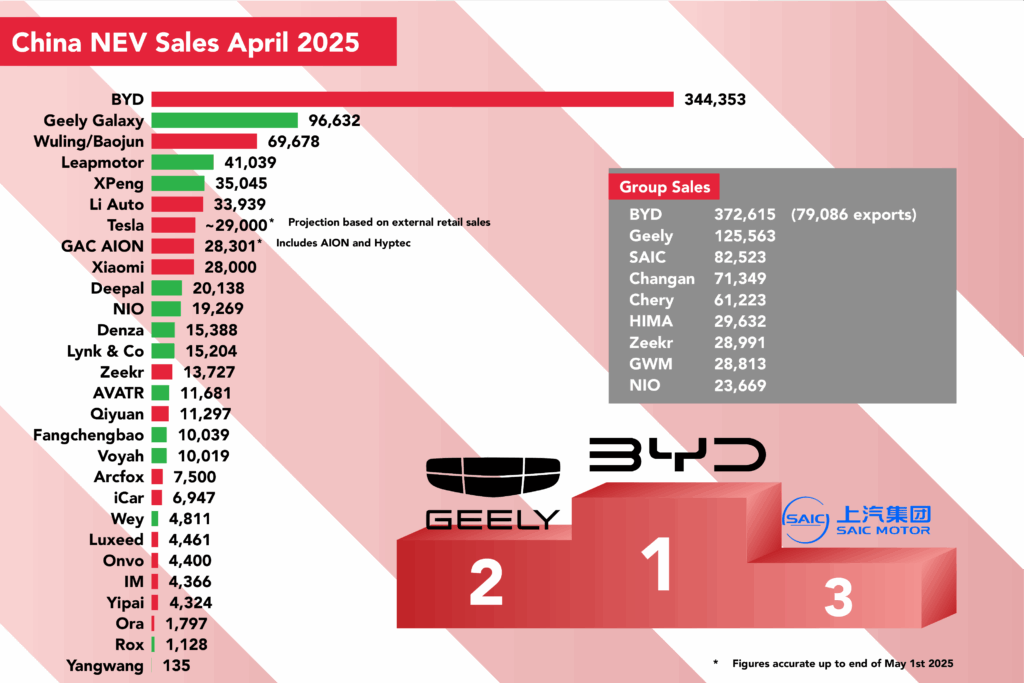

That correlates with the NEV sales figures, which are down around 10 percent month-on-month as reported by CNEVPost, but up 10 percent year-on-year.

It certainly makes for interesting reading.

We’ll add those that are missing as they come in over the next few days and complete the podium.

At the front, as ever, BYD maintained a solid lead with 344,353 units delivered in March, albeit this number was a small dip compared to last month, possibly ahead of a near full range refresh which seems to be underway.

Sales were still up 43 percent year-on-year, outgrowing the market, and in particular international sales hit a new high, 79,086 sales making it the fifth consecutive month of growth abroad as BYD continues its rapid rise.

With plenty of new models on the way offering features such as a fridge in products as small as the Dolphin, and MegaWatt charging in the Han L and Tang L, things continue to look up for BYD.

A cracking month for the Geely Galaxy range sees them get within touching distance of the 100k mark, setting a personal best of 96,632 units in April.

This equates to seven percent up on March, and a massive 281 percent up on last year’s result, indicating that Geely is going full speed ahead with their electrification plans and in impressive style.

Wuling and Baojun collectively hit a total of 69,678 units in April, a 22 percent drop on last month, but an 83.2 percent gain on last year.

Given their relatively high sales, and month-to-month fluctuations, there shouldn’t be too much concern, though Geely’s Galaxy range is potentially eating market share and they’re safely into second place now above the perennial high performers.

Of the total, 49,971 should be from Wuling, meaning Baojun will be adding around 20,000 to the total.

Leapmotor’s ongoing success story continued unabated in April with 41,039 deliveries making it their second best month on record after the year-end highs of December.

After overtaking Li Auto last month, admittedly a far more expensive brand on average, they’ve cemented that position this month with sales up a handy ten percent on March, and 174 percent year-on-year.

That’s before B10 deliveries have really started and ahead of the imminent launch of the B01 saloon that was revealed at the Shanghai Auto Show last week.

XPeng’s record run was also at full steam in April, 35,045 units making it the brand’s second best month on record, and a full half-year with sales consecutively topping 30,000 units.

A decent month-on-month improvement of five percent reversed a drop being Li Auto in March, while year-on-year the brand is up a staggering 273 percent, demonstrating just how much the arrival of the MONA M03 and P7+ have turned their fortunes around.

With the G7 set to be another winner, the refreshed X9 about the come on song, and the refreshed G6 and G9 reporting good improvements too, it might not be too long before we see them break the 40,000 deliveries mark and go in pursuit of Leapmotor.

Li Auto’s sales seem to have stagnated of late, with 33,939 deliveries a way down on their best-ever record, and seven percent down on last month.

Competition is coming thick and fast in their direction, AITO’s new M8 a particular thorn in the side, so they’ll be hoping the all-electric i8 makes more of a splash than the MEGA did after critics dubbed it the ‘coffin’, denting appetite for a fantastic product.

Sales are still up 32 percent year-on-year so things aren’t so bleak yet, but they’ll be wanting to show positive month-on-month progress before too long if they’re to hit their annual sales targets.

A huge turn up for the books at Tesla, and we’re not willing to call this one until we get more definitive figures, but looking at weekly retail sales data to April 27 and extrapolating that out over a 30-day month, and boosting a little for end-of-month sales, Tesla could be down at less than 30,000 sales in April.

If indeed true, this would be around a 63 percent drop on last month, and eight percent down on last year, numbers which do not bode well given the fairly recent launch of the updated Model Y, and nothing else on the horizon other than a cheaper Y.

Watch this space.

A disappointing month for GAC AION saw deliveries of just 28,301 units, down 17 percent on the previous month and up only one percent on the year prior.

The UT and RT have been on sale for some time now, and while sales boosted the brand’s numbers briefly, it’s clear they’re not sustaining them at the moment.

Almost every month of 2024 saw a better performance than April’s this year, leading us to wonder what’s going wrong at AION. These are decent numbers but not going in the right direction.

Xiaomi reported sales of 28,000 units in April, down four percent on March, their first month of decline since the SU7 stormed onto the market a year ago.

It’s unlikely they’ll be too concerned, with waiting list already reaching deep into next year, and it might even be a small respite as they look to scale up capacity ahead of the YU7 launch in summer, a car expected to take their numbers to another level.

It’s not inconceivable they’ll be above 50,000 units when the YU7 comes on stream, maybe even over 60,000, a remarkable figure for a brand with basically two models, but let’s see.

Deepal didn’t have their greatest month in April, sales down 17 percent on last month, and they’re on the edge of falling into the clutches of NIO.

While sales are up 58 percent year-on-year, this is their second worst result of the year and far behind their peak of over 36,000 sales in November and December last year, so they’ll be looking for a boost from the S09 when it goes fully on sale and up against the Lynk & Co 900 and Li Auto L-series models.

NIO took a turn in the right direction in April, a hefty chunk of sales, surely in some part down to the ET9, helping them to 19,269 sales, up 47 percent on March.

Year-on-year, sales were up 23 percent, which is reasonable, though down on Li Auto, and it should be noted the monthly figure was lower than the last eight months of 2024.

Still, a positive step at least for the main brand and a good omen for ET9 sales, though we’ll have to see how these bear out in the longer run.

An impressive month for Denza moves them ahead of Lynk & Co in the standings, 15,388 units a solid improvement of 18 percent on the previous month.

Year-on-year, the improvement is an even greater 38 percent, Denza really starting to gain some traction, though sales are still predominantly dependent on the D9 MPV.

That could change as the new N9 SUV sales get underway, as it looks to take on the Li Auto range and the recently-launched, and much more affordable, Lynk & Co 900.

Sales of Lynk & Co new energy vehicles topped 15,000 units in April, up seven percent on the month prior, which is a decent result.

They’re also up a healthy 63 percent on last year, and NEVs made up 55.3 percent of all Lynk & Co sales and by observation in on the ground, the Z20 seems to be doing well for the brand in China.

More momentum is needed, and perhaps the surprisingly affordable 900 SUV could boost those numbers as it goes head-to-head with Li Auto’s L8 and L9, and the AITO M8 and M9.

April was a dreadful month for Zeekr, deliveries of just 13,727 marking an 11 percent drop from a disappointing March, and worse, a 15 percent drop year-on-year.

This performance was their second worst of the year despite two holiday-affected months for Chinese New Year, and worse than all nine months from April onwards in 2024.

There’s no logical explanation for this result, a very strong range of remarkably affordable cars performing so poorly given the might of the organisation supporting them. The 007GT and 9X aren’t going to save this, so what next for Zeekr?

AVATR had their best month ever in April, 11,681 units a ten percent improvement on March, and a 122.6 percent improvement on the same month last year.

Sales of the brand’s most affordable model, the 06, have just begun which should give them an additional boost in May, though sedan sales aren’t the easiest to achieve so it could be a modest bump despite the 06’s stunning looks.

A poor month for Qiyuan sees them drop several places in the table, 11,297 deliveries down month-on-month by more than a quarter, and, more concerningly, down 32 percent year-on-year.

On the plus side, Changan is reporting 31,057 pre-orders of their new Q07 large SUV, and new images have surfaced of a sleek looking saloon, the A06, which should both boost figures.

Fangchengbao had their best month of the year, and likely their second best month ever, with 10,039 sales taking them ahead of Voyah in the charts.

That’s a healthy 20 percent gain over last month, and a hefty 376 percent gain on last year, before the Bao 8 came online and just as the Bao 5 was getting started.

With the more affordable Tai 3 about to begin sales, this number still has plenty of room for growth in the months ahead.

Voyah once again reported monthly sales just north of the nearest thousand, with 10,019 deliveries a 7 car bump on the previous month.

Year-on-year gains are much more pronounced, up 150 percent, and the brand will be hoping their updated FREE with Huawei’s ADAS system included will see a bump in sales.

The FREE, Courage, and Zhuiguang certainly need something to kick things up a gear for Voyah whose sales are predominantly held up by the popular Dreamer MPV, which itself has Huawei tech and ADS technology inside now.

A terrible month out of the blue for Arcfox, just 7,500 units (a conveniently round number) reaching customers, down 42 percent on last month.

The good news is at least a 260 percent gain on a pretty bad April last year, but they’ll want to ramp up quick, and they’ll need the new T1 supermini to hit the ground running.

iCar’s April sales were ever so slightly down on March, which isn’t ideal but within the boundaries of fluctuation, but a year-on-year growth of just two percent suggests the brand needs to be moving forwards now.

With three cars now in the range, there’s decent scope to be hitting 10,000 units a month, and if the battery swapping V23 and the EREV versions of the 03 come on stream soon, these numbers could get a boost.

Sales in the UK in 2026 have been announced by Autocar too, under the name iCaur (?), so let’s see how things develop.

Wey had a decent month, climbing a few places in this list despite not exactly lighting up the growth charts, a total of 4,811 deliveries marking a three percent gain on last month.

It’s also a modest eight percent up on last year, which outperforms the market, but these still aren’t great numbers for Wey.

Luxeed had an absolute stinker of a month in April, with Chery, the maker of Luxeed, reporting sales of just 4,461 units, a whopping 55 percent down on the 10,005 units reported in April.

Year-on-year, it’s a far more acceptable but no more comforting 11 percent drop, which given Luxeed was struggling with manufacturing issues last year, is not a good look for this year.

With no new cars on the horizon, it’s hard to see where Luxeed is really headed at this point in time.

Onvo had a month to forget in April. Down nine percent after firing their underperforming CEO, they’ve yet to get close to consistent sales even near the 10,000 promised by the outgoing CEO.

The new CEO has a good record with NIO Power though so we’ll see if his arrival bears fruit, and whether sales of the new L90, launched in Shanghai, will have a positive impact on sales, as and when it becomes available.

SAIC brand IM had another poor month, somehow down on last month’s dire performance, with just 4,366 units rolling out the showrooms.

This is down 13 percent on the previous month, but at least 55 percent up on the year prior, so there’s a silver lining but not much of one.

With no new models on the horizon, it’s hard to see where they go from here, other than overseas.

Things go from bad to worse for Ora, somehow achieving their worst month of the year with just 1,797 units finding homes.

That’s a massive 35 percent down on last month, and 49 percent down on last year.

Insiders at the Shanghai Auto Show were told the brand will be moving into plug-in hybrids in future in order to save the brand and try to coax more sales, though that feels like a stop gap that will need marketing to bring the brand back into public awareness.

ROX Motors once again joins our list, sales of 1,128 units in April a boost of six percent on the prior month.

We don’t have figures for every month of ROX’s sales but with the brand announcing cumulative sales of 10,000 units, we’d have to expect this is a record month for the brand whose portfolio only features the 01 currently.

We have a review of the 01 coming up on our YouTube channel very soon so stay tuned.

Yangwang, as the most premium brand on the list, sits at the bottom of our charts.

April was at least a minor improvement on last month, the brand shift two extra cars, but it was a sizeable 85.8 percent drop on last year as demand for the high-end arm of BYD wanes.

The U7 and the long-wheelbase U8 are set to enter the market, which could offer a bump, but we’ll wait to see just how much of a boost they provide.

Leapmotor’s climb is impressive, especially overtaking a premium player like Li Auto. It’ll be interesting to see whether this momentum holds as the market becomes more competitive in the second half of the year.

It is hard to visualize the behemoth BYD tolerating a sub brand selling just over a hundred a month especially considering the huge development costs for those cars. Even as halo cars.