All brands improve on a short February but some show year-on-year struggles.

China’s NEV sales are in and, after the first two interrupted months of the year, it was pretty much back to business as usual as brands head off in pursuit of the traditional year-end highs.

Month-on-month sales were green across the board as expected, with some brands that have been somewhat shy of sharing numbers in recent months once again returning to reporting their figures (Yipai, ROX), while some others have uncharacteristically gone into hiding (HIMA, Nammi).

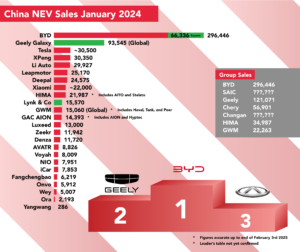

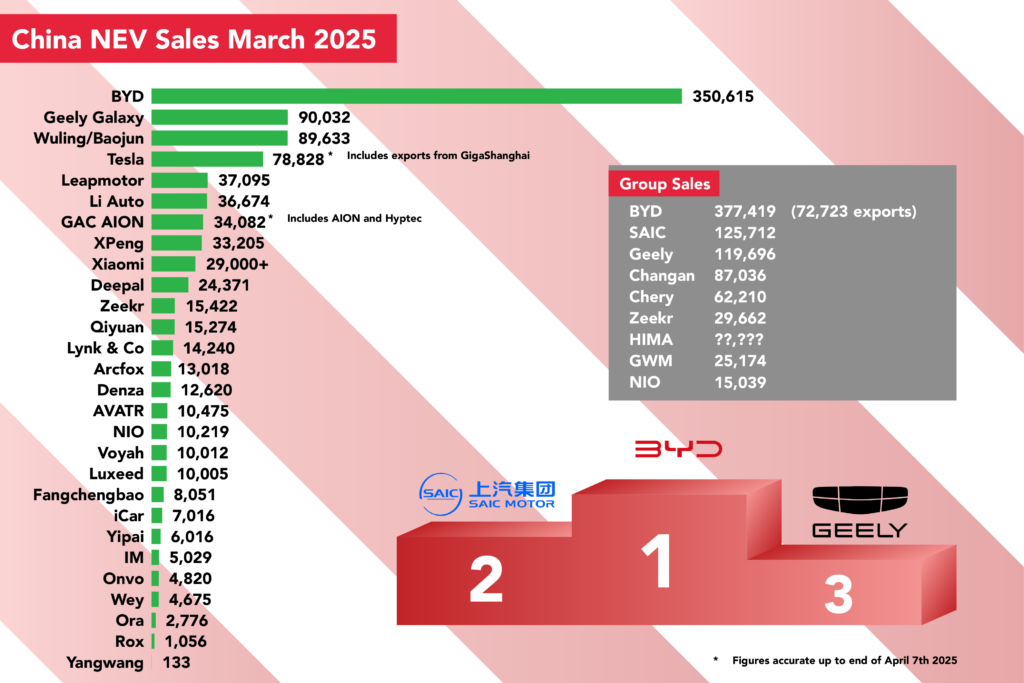

Nevertheless, it was the same old story out front, BYD having a record March and another record month of exports, topping 70,000 exported units for the first time, this time followed by a resurgent SAIC who beat out Geely Group to second spot on the group table.

Changan, too, made strides in March, surging past a stagnant Chery, whose export title for all fuels looks at risk from several other groups in 2025, with the list rounded off by the newly formed Zeekr Group, the NEV-resistant Great Wall, and then NIO, who need to seriously pick things up to turn this year into a success after the departure of Onvo boss Alan Ai and heavy cost-cutting across the globe.

Into the meat of the brand table though, it’s BYD sitting pretty, waltzing to a monthly total of 350,615 after one of the most commanding first quarters in automotive history.

In addition to launching the Han L and Tang L with 1 Megawatt charging capability and 580kW motors, they opened up their God’s Eye C ADAS hardware and DiPilot 100 software to every single car in their range, free of charge, and unveiled a bunch of other products on top.

It’s starting to feel like BYD is about to turn the screw on every competitor that dares come at them this year, so with 47.5 percent month-on-month (MoM) gains and 42.3 percent year-on-year (YoY) gains, don’t bet against them torching more records with each passing month.

Slipping above the ever-present SGMW venture, Geely’s Galaxy range goes from strength to strength, netting a 90,000-plus month in March.

That’s still only a quarter of BYD’s number, which tells you something of the scale of the task ahead, but a useful 18.3 percent gain MoM is dwarfed by an enormous 545.9 percent gain YoY, suggesting Geely is now ready to throw the kitchen sink at reeling in the market leader.

Taking the final podium place, Wuling and Baojun slipped in just behind Geely Galaxy with 89,633 sales, the new four-door Hongguang Mini EV proving a useful addition, alongside Baojun’s new saloon.

Sales were up 56.8 percent MoM, a pretty strong figure even accounting for a short February, but also 24.4 percent YoY, which shows there’s still plenty of growth yet in one of the freshest budget line-ups on the market.

To see where these brands have come from in the space of just three years is to almost look at two different companies, such has been the revitalisation of the range.

After a somewhat tumultuous quarter for Tesla, punctuated at one end by the arrival of a refreshed best-seller and the other by global protests over the owner’s antics, March’s sales result raises further eyebrows.

A total of 78,828 units sold includes both domestic sales and exported models, so while that’s up 156.9 percent on last month’s low figure that was affected by Model Y ramp-up, it’s only 26.3 percent up on last March’s China domestic sales figure, and 11.49 percent down on the wholesale figure that includes exports.

Currently it would still keep Tesla comfortably in fourth-place on this list but in a market that’s clearly growing, it’s a worrying trend. We’ll have to see if things stabilise or confirm the slump when April’s figures come around, but perhaps the competition really is starting to make up some ground.

Living up to their name, Leapmotor stormed the charts in March, surpassing both Li Auto and XPeng with an excellent result of 37,095 units.

This marks a 46.7 percent improvement on February, and a whopping 154.7 percent leap on March 2024, and that’s even before the new B10 hits dealerships in a few days’ time.

With strong figures coming in from Europe, it looks like Leapmotor is all set for a strong year.

Li Auto returned to form in March, likely once again beating out AITO (though without HIMA releasing the number we don’t know for sure), but things do feel a tad stale.

They became the first of China’s start-up new energy brands to hit one million sales, an impressive achievement, but the explosive growth is starting to tail off a little. No surprise really, since they can now be seen all over China in every tier of city.

The 39.6 percent MoM gains are to be expected, but 26.5 percent YoY gains almost feel surprisingly low, like there was ever a time when Li Auto weren’t selling 30,000-plus cars a month.

The next interesting step for Li is to see how the public receives the fully electric i8 coming very soon, a MEGA-esque SUV that’s a little toned down from the extreme design of that model.

GAC AION climbed back above XPeng in March, which on the face of it is a decent result with the UT and RT models now fully on stream, but the numbers tell a slightly concerning story.

34,082 deliveries were good for an impressive 63.4 percent MoM growth, but YoY gains were only 4.8 percent, in a market where 25 percent should be a minimum.

Our diagnosis would be perhaps BYD is taking a larger slice of the ride-hailing market that’s been so good to AION in recent times, and so AION need to find a new outlet. Export market might just be the next remedy.

A fifth-consecutive 30,000-plus month for XPeng continues their resurgence, though they drop a few places in the table as other brands return to form.

XPeng somehow weathered January and February far better than anybody else so their MoM gains of 9.0 percent seem modest, but the YoY improvement of 267.9 percent are the real story, indicating a brand that has now firmly found its feet.

Refreshed G6 and G9 models did well enough in their first weeks for XPeng to delay the arrival of the G7 which could add another decent chunk of sales, pushing them closer to the 40,000 per month mark.

Xiaomis are seen in crashes so often these days it almost feels like they’ve found a smart way to recycle production, but waiting lists that now extend as far as 46 weeks tell the really story – the SU7 is still raging hot.

A record month in March takes sales just shy of the 30,000 mark, in part boosted by the frankly ridiculous SU7 Ultra supercar, and with the YU7 on the horizon, Xiaomi’s biggest headache will be how to make more cars fast enough.

Deepal feel some way off their best, with the Changan brand previously vying with XPeng and Leapmotor for honours, but 24,371 units in March was still 86.8 percent up on last year’s result, an above-average improvement, showing they’re still making ground.

The intriguing question will be whether the S09 large SUV can take sales from AITO and Li Auto, and whether sales in Australia will make an extra impact.

Another brand off their game is Zeekr, who feel a long way from their 27,000 peaks of late last year, 15,422 sales all they could muster in March.

This was a below-average improvement on a short and affected February, although the YoY gains of 105.5 percent might be some consolation. It perhaps speaks to how well they ramped last year that this feels a disappointing month.

They’ll be hoping the 007GT makes an impact, and perhaps some longer interest-free deals thrown into the mix might boost sales.

Qiyuan are ambling along quite nicely, 15,274 sales not too far off their monthly bests and 29.1 percent YoY gains demonstrating steady growth.

That they needed 92.6 percent MoM growth to hit this figure just shows how disappointing February’s numbers were.

A new large SUV in the mix should add a few sales, while the E07 looks set to be sold as a Deepal in Australia meaning a few extra sales on the table there.

Lynk & Co made something of a comeback in March with a strong improvement of 72.5 percent MoM, and they’ll be hoping the super impressive 900 large SUV makes a splash in the coming months, taking some scalps off Li Auto and AITO in what is fast becoming a red hot segment.

Arcfox has been on and off with posting sales figures recently, perennially sitting under the radar, but 13,018 units is a return to good times for BAIC’s new energy brand, oversized MoM gains of 155.8 percent dwarfed by 466 percent YoY gains.

The Kaola seems to have had a good impact, as well as the Alpha S5, but you still don’t see too many of them on the roads so they are still lacking maybe availability or awareness.

Denza had its best month of the year with 12,620 units, but the improvements haven’t been so impressive.

A gain of 48.2 percent MoM was reasonable enough, but only 22.8 percent YoY gains suggest their models just aren’t breaking through yet. The new N9 large SUV will hope to change that but, as with the Lynk & Co 900, it’s going into a very competitive segment.

AVATR appears to be back on song with their third best month ever, 10,475 sales good for 102.1 percent growth over last month, and 139.9 percent growth over the same month last year.

With the 06 set to join the ranks shortly, they’ll be hoping to tempt some buyers away from the Model 3 and NIO ET5 and continue their upward trajectory.

One brand that needs a boost more than most is NIO. With each passing month the premium marque seems to fall further down this list and there are rumblings that the cash burn is taking its toll.

Tiny monthly gains over a not particularly impressive February, and a hefty YoY loss of 32.1 percent over the same month last year, suggest something is not clicking.

It could be indicative of a slowdown in the premium segment, or it could be that customers are just going elsewhere and don’t feel NIOs offer the plethora of infotainment options that more affordable brands are boasting.

ET9 is not going to significantly boost these numbers, so where are the sales coming from? Can updated ET5 and ES6 models turn the tide? NIO needs answers in the next 12 months, ideally sooner.

Voyah is a brand that also need a spark of excitement, the state-owned brands generally struggling to really make a huge impact on the sales tables.

A March figure of 10,012 is about right for Voyah, who seem to have been sat at around this number for months, and the gains figures pretty much bear that out.

The top seller remains the Dreamer MPV, which is now also sold in some international markets, but they really need models like the Courage, Free, and Zhuiguang to do more heavy lifting.

Luxeed hasn’t exactly been tearing things up recently but remember they only have two models in the line-up and things suddenly look a little better. 10,005 units beat February’s figures by a single unit, which means either January and February were better than we gave them credit for, or they had a disappointing March.

Things looks somewhat rosier on the YoY chart, 212.9 percent gains suggesting they’ve at least corrected some of the mistakes of their early months. Ideally both the S7 and R7 need to be picking up sales sitting, as they do, in two very popular segments.

Fangchengbao seem to be steadily finding their feet, 8,051 units in March a decent figure for a brand whose best month topped 11,000 units, but the real game changer could be the new Tai 3.

Boasting a plethora of tech, including a drone on the roof on higher models, should be a recipe for success and the price looks good too.

A monthly gain of 62.9 percent and yearly gain of 126.8 percent are above the market, so BYD might finally be getting a decent second brand up and running, while European and Australian sales await later this year under the Denza moniker.

iCar seems a brand that should be doing a little better than it is, funky products not really translating into the sales their price tags would have you expect.

March saw sales of 7,016 units, not too bad overall and a good improvement on the year before, but with the significantly smarter, albeit not as cool and a bit more expensive, Tai 3 about to begin sales, iCar will want to pull out something smart, like maybe a production X25, at the Shanghai Auto Show.

Off our table for some time, Yipai makes a welcome return, Dongfeng obviously satisfied that 6,016 sales warrants informing the public.

Still some way off the brand’s best month that topped 10,000 units, it really feels like the products deserve more sales, but perhaps the interest-free incentives are starting to get people interested and maybe we’ll see more from Yipai next month.

Things remain a real slog at IM, and don’t be fooled by the spectacular 343.1 percent MoM growth. 5,029 units is certainly an improvement, but this is a brand that can crack 10,000 units a month and has rolled out more affordable variants and interest-free offers.

Yes, they’re up YoY by a decent 67.7 percent, but they will really be hoping international sales in Thailand and Australia start to show more promise than Chinese consumers are giving them right now.

The ‘Tesla Model Y-killer’, as so many dubbed the L60, seems a long way from even stealing sales from the all-conquering Tesla at the moment, NIO boss William Li acknowledging that public perception and poor promotion have dented their mainstream brand’s efforts.

The results have been so poor, they’ve cost the CEO his job, after he promised much larger numbers by March this year.

The swapping station compatibility debacle hasn’t helped the brand, but if lack of awareness is the issue, there’s a simple fix for that – communicate more. Let’s see if NIO Power’s former boss can turn the tide.

Great Wall brands continue to flounder on this list, Wey making the best fist of it so far with 4,675 sales of plug-in hybrids simply not enough.

Great Wall are likely happy with their petrol sales but risk being left behind without a cohesive NEV strategy, and the Wey models just aren’t getting the attention.

YoY gains of 41.2 percent are about the only consolation here but more needs to be done.

As with Wey, Ora is a brand in need of some serious love and direction. Just three years ago, Ora Good Cats were everywhere, but now they’re almost nowhere and European sales have ground to a crawl, just 2.776 units being sold in March.

Yes, they were up on February, but down 39.8 percent YoY, in what feels like the final death throes of this once funky brand. Will they revive their fortunes with something interesting in Shanghai? They’d better hope so.

A welcome entrant to our list is ROX, or the brand previously known as Polestones. We don’t have much to judge them on given the lack of prior information from the brand but 1,056 sales is certainly a little on the low side for a product that’s quite similar to a Li Auto in style.

It is, however, a genuine off-roader, and sales are going pretty well in places like Dubai by all accounts, so if this number doesn’t include those sales they might be doing OK. If it does…well it won’t be the easiest thing to keep a car company running on figures this low.

Last but not least, the most premium brand on the list, and thus an unsurprising sight at the foot of the table. Nevertheless, the shine seems to have worn off of Yangwang in recent months, steadily declining sales now hitting just 133 a month in March.

The new U7 will potentially provide a stimulus, but it remains to be seen just how much of one. BYD can do many things, but consistently sell premium cars at the level of some other expensive imports remains a challenge.