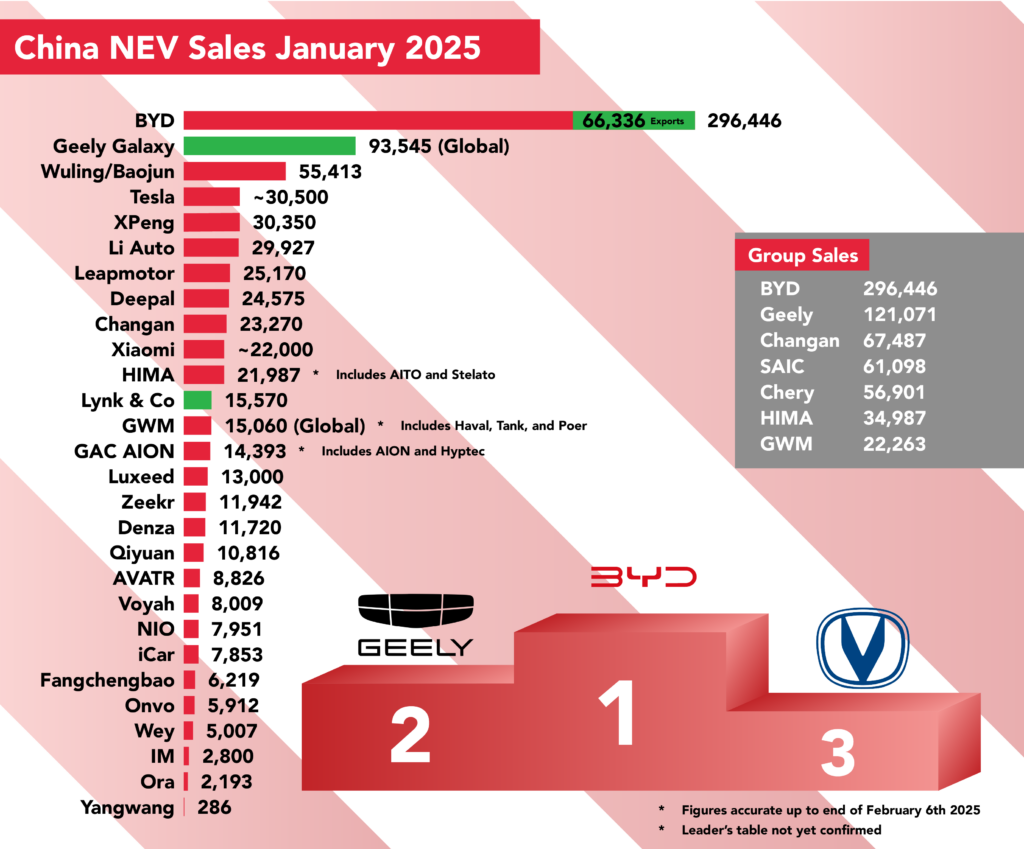

BYD’s exports, Geely’s Galaxy series, and Lynk & Co were the only brands to grow sales, while XPeng stormed the charts.

BYD once again topped Chinese new energy vehicle (NEV) sales in January, despite almost the entire market dropping heavily from the customary New Year slump, but other brands caught the eye for good and bad reasons.

We’ve become accustomed to BYD sitting atop the table by some margin and January was no exception, and while China market sales took a near 50 percent haircut from December’s highs, exports climbed 16 percent to a new record of 66,336.

Geely Auto stormed into second place in the group and singular brand tables, the 93,545 global sales of their Galaxy brand a 34 percent increase on December’s figures demonstrating impressive momentum, with 121,071 sales when combined with their Zeekr and Lynk & Co brands.

The Wuling-Baojun partnership dropped 38 percent to 55,413 units to take third place in this list, ahead of a close race between a resurgent XPeng and Tesla. XPeng’s official figure of 30,350 units, just 17 percent down on December, is a staggering achievement underscoring the success of their MONA MO3 and P7+ releases.

Tesla, on the other hand, look set for roughly the same figure based on reported weekly numbers, but they were behind XPeng after 19 days of the month. The updated Model Y, already boasting around 70,000 pre-orders, should turn things around for them, but a more than 60 percent drop in sales for January is among the largest drops of all brands.

Next up, Li Auto took a 48 percent hit in January but remained the best-selling of the premium brands, although year-on-year sales were slightly down at 29,927 units.

Leapmotor, down almost 41 percent at 25,170 units, are followed by Deepal, down nearly 33 percent at 24,575 units, and then Deepal’s parent company Changan with 23,270 sales.

Xiaomi are next up, reporting over 20,000 units, but they’re believed to have shifted around 22,000 units.

The Harmony Intelligent Mobility Alliance (HIMA) recorded group sales of 34,987 units (down 29 percent), while Chery reported 13,000 sales of Luxeed models (down 26.7 percent), of which 11,420 were the R7 SUV, meaning the AITO and Stelato brands combined brought in 21,987 units.

Lynk & Co impressively managed to outperform the market and their new owner, Zeekr, growing sales month-on-month 7.7 percent to 15,570 units.

They were followed by GWM, whose 22,263 global group NEV sales were down more than 47 percent on December’s highs. Of those, 15,060 were from the Haval, Tank, and Poer brands, down 48 percent, while Wey fell to 5,007 (43 percent down), and Ora to 2,193, down almost 54 percent – worrying numbers for the group’s only EV brand.

GAC AION plummeted down the charts, just 14,393 cars finding homes in January, a drop of almost 70 percent the largest of all brands in this list. The new AION UT hatch can’t come soon enough, but it’ll have to wait until the end of February.

Zeekr, despite hitting 15,000 total deliveries in Australia a few days ago, seem to be stalling in their home market, and suffered a 56 percent drop in sales in January to just 11,942 units.

Denza, on the other hand, dropped only 22 percent to 11,720 units, ahead of Qiyuan with 10,816, 41 percent down on their last reported number from November, and then AVATR whose 8,826 units were just 20 percent down on December, a strong result.

Voyah, with sales of 8,009 units, took a reasonable 34 percent drop in January, and they were followed by NIO, whose 7,951 sales was a 21 percent drop on last January, and a 61 percent drop on December, a figure that’s spurred them to offer 5 years’ zero percent financing in China.

Such was their dip, young Chery brand iCar closed to within 100 units of the premium marque, their 7,853 units only dropping 24 percent month from December as a result of the popular new V23 model.

They led BYD brand Fangchengbao, whose 6,219 units were a drop of 45 percent over December, and NIO’s Onvo brand, which dropped nearly 44 percent month-on-month to 5,912 units.

Bringing up the rear between Wey and Ora is IM, whose meagre 2,800 sales is a massive 65 percent drop on December’s already disappointing figures, followed by high-end brand Yangwang, with 286 units.

At the time of writing, figures from Arcfox, Neta, Yipai, and Nammi haven’t been released. We’ll add these as and when they arrive.

Editor’s Note

January is always an off-month for Chinese car sales, this year more than most due to Chinese New Year starting on the 29th, but to write off all the losses as equal would be disingenuous.

Some brands can still hold their heads high, such as Xiaomi, AVATR, and in particular XPeng, who seem ready to become a permanent present in the upper echelons of the sales charts. We knew MONA 03 and P7+ were in good shape in December, but to pull put a 30,000-plus month in January is no mean feat.

Either there was a lot of hard work at XPeng, or they’re really onto something. The upcoming G7 will no doubt be another boost to their turnaround.

On the flip side, GAC AION, NIO, Tesla, IM, and Zeekr, all took major losses in January. AION, with some of the more affordable cars on the market, had looked back on track in December thanks to RT sales, and the UT might yet get them there again, but it’s hard to look past a near 70 percent drop in sales. Something needs rectifying.

The same issue is perhaps even more prominent for IM, whose disappointing lack of sales shows no signs of abating. They simply cannot catch a break and SAIC now look to be almost fully dependent on quickly getting cars onto international markets where they hope they’ll find more success.

NIO and Zeekr also look to be having a hard time of it. NIO had been on an upward trajectory of late, and it’s entirely possible that the wallet-tightening of Chinese New Year hits more premium brands unduly hard, but Zeekr’s malaise is harder to pin.

While other, albeit more affordable, brands have made leaps and bounds in recent months, Zeekr seems stuck in a middle ground, unable to grow at speed despite imaginative and technically outstanding cars at reasonable prices. Exports seem to be doing well enough, but they need to sort out their home form.

Tesla, despite a huge drop, does tend to bounce up and down a bit each month, and given the refreshed version of their best seller by far was revealed on January 10th, their number seems more like a coming together of important factors rather than the growing animosity to their owner abroad. No doubt the Y will throw them back towards the podium again in no time.