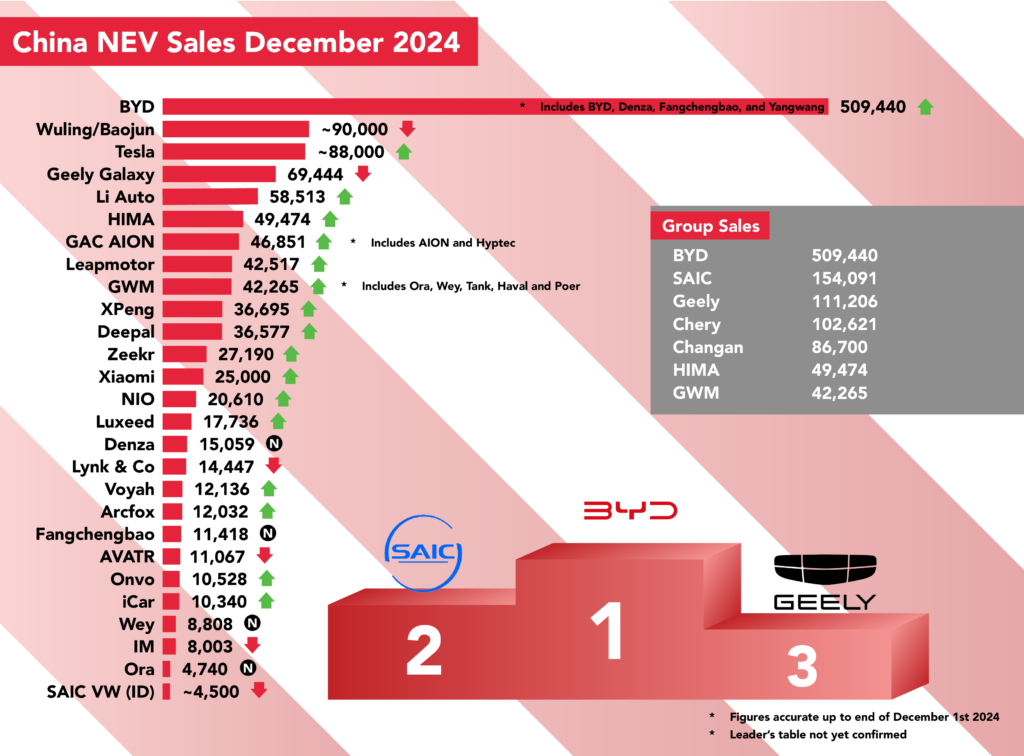

Almost all brands see increases with many hitting record monthly sales in end-of-year push.

Chinese new energy vehicle (BEV, EREV, PHEV) sales benefitted from the annual end-of-year sales push to hit new monthly heights across almost all brands.

Big winners were Li Auto, who turned around a dip in form over the last few months to hit a new record and become the first Chinese start-up NEV maker to pass the half a million annual sales figure, as well as HIMA, Great Wall, XPeng, Luxeed, and iCar, who all boosted previous months figures by more than 17%.

Leading the way once again was BYD, with a third straight month of half a million plus sales, their 509,400 figure including 15,059 from Denza, and 11,418 from Fangchengbao.

Interesting to note was their export sales hitting a record 57,154 units, up from a previous best of 41,011, and also the shift in balance between EV and PHEV, with last year’s EV share topping 52 percent, compared to just 41.5% this year, showing the growth was mostly from PHEV sales, up almost 73 percent in 2024.

SGMW, the SAIC-GM joint venture for Wuling and Baojun, took second place with around 90,000 sales, this data extrapolated from SAIC’s monthly data and SGMW’s claim of new energy sales being more than half of the share.

They are followed by Tesla with around 88,000 deliveries, based in weekly compiled information from ThinkerCar, and then Geely’s Galaxy range with 69,444 units, down eight percent on last month.

Records Broken

Li Auto climbed a full 20 percent from November after two successive months of decline to register a new monthly high and reach 500,508 units for the year.

Rivals HIMA climbed the chart with a stellar month, their total of 49,474 up 18 percent from November, though this number is a little confusing with Seres, makers of the AITO brand, claiming 37,319 deliveries and Chery, makers of Luxeed, claiming 17,736 deliveries, which would equal 55,055 units, though it’s possible 5,581 of these were from Seres’ own brand version of the M5.

GAC AION sales rose 11 percent to 46,851 units on the back of strong early sales of the AION RT that claimed over 16,000 of that number, and they were followed by Leapmotor hitting new heights of 42,517 units, up six percent on November.

A strong month for Great Wall Motors saw gains of 17 percent, their total of 42,265 including 8,808 units from SUV brand Wey, and 4,740 from Ora, who continue to struggle.

XPeng deliveries scaled new heights, overtaking Deepal with 36,695 units thanks to more than 15,000 deliveries of the MONA M03 and more than 10,000 units of the new XPeng P7+.

Despite being toppled by XPeng, Deepal’s figure of 36,577 was a new monthly record for them, with total year deliveries of 243,894 capping a strong year for the Changan brand.

Mid-table players

Zeekr only managed a mild month of growth to reach 27,190 units, and look perilously close to being overtaken by a rampant Xiaomi whose monthly deliveries hit a record 25,000 units on their way to topping 130,000 deliveries in just eight months.

Next up was NIO, 20,610 units being a good month for their flagship brand, which we’ve separated from the mid-level Onvo brand whose sales pretty much doubled to 10,528, taking the NIO family to a record 31,138 units ahead of an April launch for their firefly brand.

Lynk & Co suffered a 28% drop in sales in December, despite sales of the new Z20 beginning and the Z10 now well underway, with their new model expected to launch on January 3rd. It might be needed.

Voyah sales climbed 12 percent to 12,126 units in December, a fourth consecutive month over 10,000 units for them, followed by Arcfox with 12,032 units, both figures sales records for the brands.

AVATR sales dipped four percent to 11,067 units in a somewhat surprising stall. They’ll be looking forward to sales of the 06, revealed here, commencing later in 2025.

iCar sales jumped a massive 80 percent to 10,340 units, suggesting early deliveries of the V23 have gone very well, with 31,000 deposits taken on that within eight hours of it going on sale.

Things don’t look great at SAIC with IM sales down 20 percent to 8,003, and SAIC VW (ID) sales we’ve calculated at roughly 4,500 based on their reported numbers throughout the year being subtracted from their reported annual deliveries, which would be a roughly 68 percent dip on November.

Group Sales

Some brands haven’t reported their individual brand figures, such as Chery, GAC, and Dongfeng, so we’ll insert those if and when we get them, but on the group front, it was BYD leading the way with 509,400 units, ahead of SAIC with 154,091, Geely with 111,206, Chery with 106,621, Changan with roughly 86,700, HIMA on 49,474, and Great Wall with 42,265.

-1-300x200.jpg)