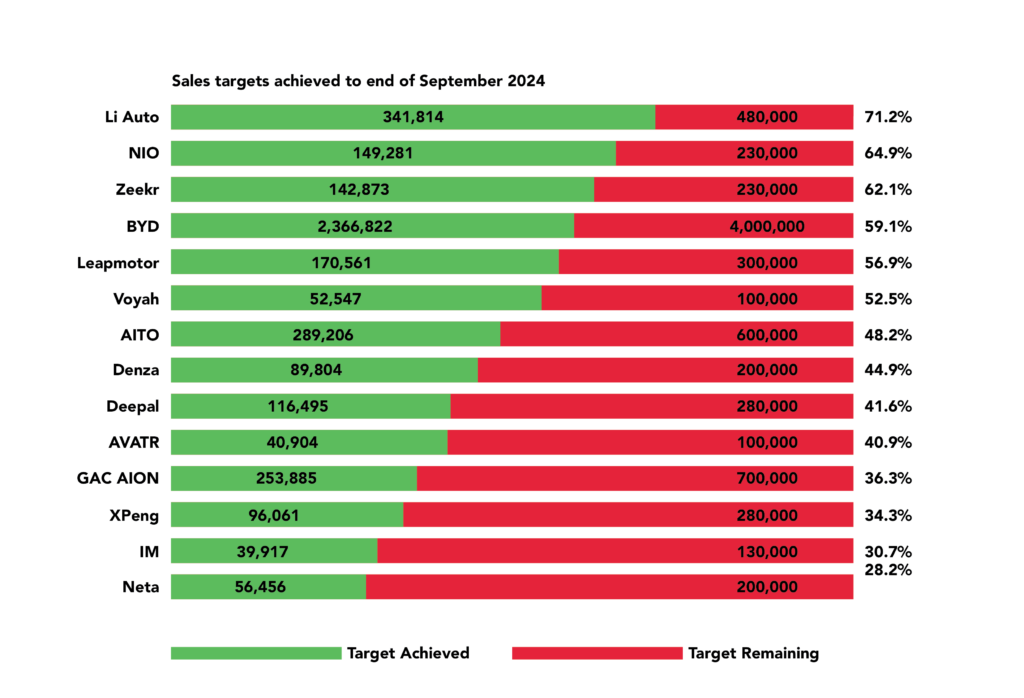

Despite a booming year for NEV sales in China, most Chinese NEV makers will fall well short of their 2024 sales targets according to research by CarNewsChina.com.

Despite NEVs now making up more than half of total monthly car sales in China, the figures show more than half of the brands investigated are currently tracking at less than 50% of their stated annual goal by the end of Q3, this despite most brands selling around 30-35% of their total annual volume in the final three months of the year.

Those figures suggest a good 11 of the 14 brands tracked will fail to hit their full year sales targets, and one of the possible successful candidates had already slashed their annual forecast from 800,000 units down to just 480,000 earlier this year.

That brand is Li Auto, who currently lead the way with 71.2% of their revised achievement rate. Had they not chosen to revise the early year figure, they’d be at just 43.2%, suggesting the immense success of 2023 might have had something of a Kool-Aid effect on the brand’s planners for 2024. Nevertheless, the brand has recovered well from disappointing sales of the MEGA MPV and the delay of further full electric models as a result, achieving record sales months in August and September.

The only other brands seemingly in with a shot of hitting their targets for 2024 are Nio and Zeekr, currently tracking at 64.9% and 62.1% of their targets respectively. It’s unclear if Nio’s target of 230,000, down from 245,000 in 2023, includes Onvo sales, though these could be crucial to achieving this success in the closing months of the year. The more affordable brand launched their L60 in September and on the back of rave reviews, it could see Nio close in on 30,000 sales or more per month before the year is out.

For Zeekr, the incoming sales of the 7X SUV and expected launch of the MIX MPV in the coming months could be a crucial factor too. The 7X is the brand’s first model to really sit in a volume segment that’s popular in China and pre-sales figures look good. They’re just under 90,000 sales off their 230,000 annual goal and running at just over 21,000 a month currently, meaning they’ll need to add about 7,000 sales a month to hit the magic number.

Elsewhere, however, it’s been a bruising year. Despite BYD blowing all other brands out the water every month, they’re only at 59.1% of their target with three months to go. Even three more months at 400,000 units a pop would see them fall short, but you can never quite doubt the Goliath that is BYD, especially if their goal is a global one where sales are increasing rapidly.

At 170,561 sales, Leapmotor are still well short of their 300,000 goal, and we can’t expect European and Australian sales to really ramp up fast enough to save the figure. They’ll get close with another 100-120k sales expected between now and the end of the year, so keep an eye out for them.

Voyah are next up, at 52.5% of their annual goal. It’s been a slow first eight months of the year for the brand, totalling just 52,547 sales so far, but 10,001 of those came in September alone. Match that three times and they won’t be too far off their 100,000 goal.

AITO has been going great guns this year but growth is stalling slightly. At under 50% of their annual goal of 600,000, the third highest target on the list, they’re quite simply not going to hit their lofty prediction before year end and we’re not expecting any new volume-sellers in that time.

At 44.9% of their 200,000 goal, Denza is also well off the pace. Clearly the brand expected more from the N7 SUV which hasn’t really been a sales hit, and the Z9 GT isn’t going to close that gap anytime soon, so they’ll need a volume seller or international sales to pick things up.

Deepal are the final brand above 40% of their annual target so far, a fairly chunky 280,000 unit expectation. Sales are steady at just over 22,000 a month. A couple of new models will help a bit but don’t expect them to move the needle too much.

GAC AION, with a whopping target of 700,000 units, are way off the pace in 2024 at just 36.3% of their stated goal. It feels like you see AION Ys everywhere, and a bunch of AION Ss in Guangzhou and Shenzhen, but the numbers clearly aren’t there. The updated V might start to gain some ground in the coming months but there will be some head scratching going on at GAC as to how they got things so wrong.

Next up are XPeng, also miles away from their target of 280,000 with under 100,000 sales so far this year. The MONA M03 looks set to salvage a strong end to the year, perhaps taking sales above 30,000 a month for the final three months if early indications are anything to go by, but even that would put them about 100,000 shy of the goal. They need to find a way to move more units of the brilliant G6 and fast. Expect more export sales in 2025 with the brand gaining good momentum in European markets and Australia.

AVATR’s year has certainly been trending downwards since an impressive January, but as a brand they should be safe given the huge names behind them (Changan, CATL, Huawei), and the incoming 07 SUV should improve their fortunes somewhat. They’re playing in a segment that’s neither all-out premium like NIO and yet not quite ‘mainstream plus’ like XPeng and to a lesser extent Zeekr, and that’s a difficult place to be. Stunning though they may be, they’re on the pricey side and can be a little too smart for their own good. They’ll be looking to their upcoming EREV models to improve things.

Bringing up the rear are IM (30.7% of target) and Neta (28.2%). It’s fair to say that there’s been far more ambition than sales talent going on at these two brands. IM, very competent and impressive cars in their own right, just will not roll out of the dealers. They’re competitively priced but a bit ugly to these eyes at least. It would be great to see some consumer survey on how IM is perceived as a brand to help clarify what’s going on.

Neta had a pretty good year in 2023 and have started selling in many foreign markets with some success, but back at base their range is just not cutting it. The updated V, now called Aya, is almost non-existent compared to its cheap and cheerful predecessor, and the X SUV and brilliant S saloon are rarely seen on the streets. The estate version of the S isn’t going to be a big seller here at least either. It’s sad to say but right now I’d put them top of my ‘brands in danger’ list for 2025.

Editor’s note:

So why are so many brands behind their targets? It’s not unusual for high targets to be set by bosses at Chinese companies, in fact it’s expected, and the incredible rise of the NEV segment has no doubt led some to believe it’s an endless growth curve. It will be for a while but the pace is becoming more steady, and we’re already seeing a steady trend towards including EREVs as well as BEVs in line-ups with Zeekr, AVATR and XPeng all putting plans on the table.

The successes of Li Auto and AITO have shown there’s a gold mine there to be found. This could be the turning point for a rapid decline in legacy brand sales in China. Many now trust the local brands as much as their foreign rivals but aren’t quite ready to ditch petrol, so EREVs might be the key they need. Hybrid Denza D9s have already all but wiped out the Buick GL8, and in some cases the Alphard, outselling the BEV D9 nine to one. As such, you could see models like the AVATR 07, Zeekr 7X and XPeng G9 (just examples, there are no plans we know of for these cars) doing the same for GLEs and X5s if offered in EREV form.

2024 will be sobering on the targets front so I’d be surprised if most brands didn’t hold steady on their goals for 2025. In most cases, they might just have a chance to reach them.

**Edited October 4th to correct the AVATR figures from around 27,000 to around 41,000.

Research completed by CarNewsChina.com