China’s NEV sales, meaning full electric and hybrids, topped 50% in a single month for the first time in July with the country’s electrified vehicle take-up rate continuing to accelerate.

In total, more than 991,000 new energy vehicles found their way into customer hands despite the usual summer slump, after June saw the second-best month of NEV sales ever with sales topping one million for just the third time.

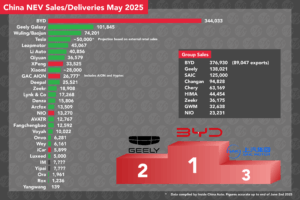

Leading the way by a country mile, as ever, was BYD with 340,799 sales, almost five times that of second place, and one of only a few brands to beat their June performance.

Bear in mind that figure includes sales of BYD, Denza, Fangchengbao and Yangwang vehicles. BYD sales are roughly 50:50 BEVs to PHEVs.

Tesla sales were down slightly to 74,117 amid seemingly stagnant demand in China, but the Model Y took the top spot for EV sales with 52,557 deliveries helping them to a comfortable second place ahead of Geely Auto.

Their 59,051 sales were down somewhat from the 65,959 units registered in June as a couple of models get refreshes, and include the Geely (Star, Galaxy and Geome ranges), Livan, Lynk & Co, and Zeekr brands.

Li Auto continued their impressive streak with 51,000 sales of EREV and BEV models, up from 47,774 in June, as L6 deliveries continue to gain traction.

The figure means the brand achieved its best-ever month of sales.

Changan sales took a big hit in July, down from 64,000 the month prior to just 50,000 in July. Their figures include the Changan, AVATR, Deepal and Qiyuan brands.

Chery climbed into sixth place at the expense of the Huawei alliance, their sales marginally up to 45,370 in July likely as result of iCar 03 and Exeed ES/ET sales steadily ramping up.

HIMA, the Huawei alliance that includes AITO, Luxeed, and now Stelato, saw a slight drop in sales to 44,090 in July, losing ground on Li Auto in the battle of the EREVs.

Further down the list, GAC AION sales remained stable at around 35,000 units, while GWM dipped to 24,145 with the Haval, Wey, Tank and Ora brands.

Other notable stories include NIO dipping slightly but staying above 20,000 units, and Xiaomi sales climbing to 14,000 from 10,000 in June as production continues to ramp up for one of 2024’s most exciting cars, the SU7.

XPeng and Neta both posted marginal gains ahead of expected new model launches at the August Chengdu Auto Show, while Leapmotor dipped but remained above 20,000 sales.

Their C10 and T03 models are set to debut in Europe later this year and the first batch set sail for the continent at the end of last month.

Arcfox, IM and Voyah all remained stable at around 8,000, 6,000 and 5,500 sales respectively.

Expect a further drop in overall sales in August as the mid-summer numbers take a knock for the holidays, before a continued climb to the end of the year where December tends to be the biggest sales month.